Gift and estate planning with DEFHR can ensure that horses have a safe place to receive healing care for years to come; it may also help you increase income, reduce income taxes, eliminate capital gains tax, and/or pass assets to your heirs while reducing estate tax.

Consider supporting DEFHR through one of these common approaches to Planned Giving:

DEFHR’s experienced Development Team will work with you and your professional advisor to develop a personalized gift plan that reflects your needs and desires.

Ready to plan for the future with DEFHR? Click here to contact DEFHR’s Development Office.

Bequests

A charitable bequest is one of the easiest ways you can leave a lasting impact on the horses at DEFHR. A bequest may be made by including language in your will or trust directing that a gift be donated to DEFHR. You can donate retirement plans (401(k), IRA) and life insurance/annuities as well by naming DEFHR as the beneficiary.

If you are considering a bequest, you will need to provide your attorney with the following important information:

Name and address of the organization:

Days End Farm Horse Rescue

1372 Woodbine Road

Woodbine, Maryland 21797

Phone: 301 – 854-5037

Tax ID Number: 52 – 1759077

Tax Status: Not-for-profit 501(c)(3) corporation

Contact at DEFHR:

Caroline Robertson

Development Director

301 – 854-5037

Charitable Trusts

Charitable Lead Trust

Support DEFHR’s future while providing a legacy for your heirs by establishing a Charitable Lead Trust.

When you contribute securities or other appreciating assets to the Lead Trust, the trust will make annual payments to DEFHR for a specified period of time. When the trust terminates, the remaining principal is paid to your heirs — including all appreciated value tax-free.

Annual payments can be set as a fixed dollar amount or as a percentage of the trust principal. The term of payments is also flexible, lasting for a specified number of years or for a lifetime.

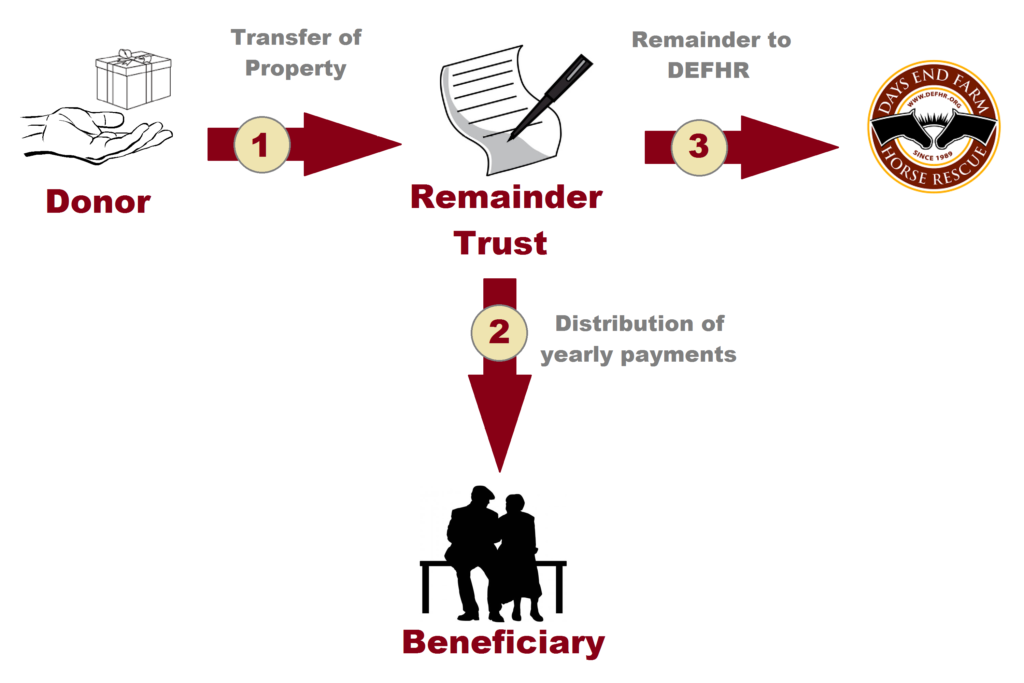

Charitable Remainder Trust

Secure future income by establishing a Charitable Remainder Trust.

When you contribute securities or other appreciating assets to the Remainder Trust, the trust will make annual payments to you or a specified beneficiary for a period of time. When the trust terminates, the remaining principal is paid to DEFHR to be used as you have directed.

Annual payments can be set as a fixed dollar amount or as a percentage of the trust principal. The term of payments is also flexible, lasting for a specified number of years or for a lifetime.

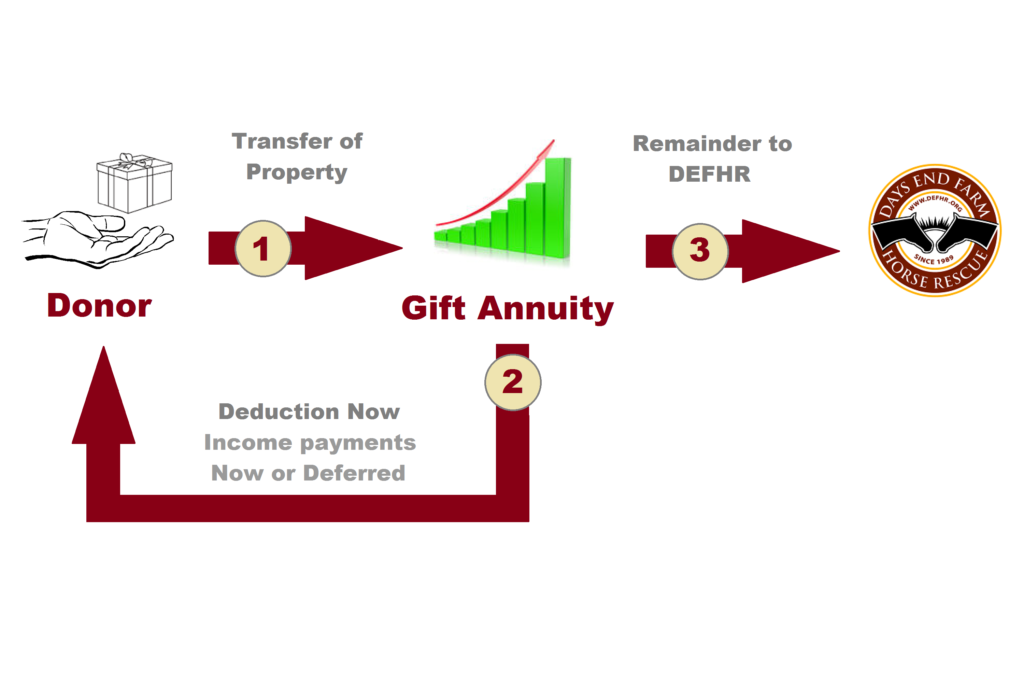

Gift Annuities

Strengthen your retirement income by establishing a Charitable Gift Annuity.

When you contribute cash or securities to DEFHR, DEFHR will pay you or your beneficiary a fixed income for life. Charitable Gift Annuities are recommended for donors aged 65 or older.

Not ready to retire yet? Income from a gift annuity can begin immediately or can be deferred for period of time, resulting in larger payments later in life. Deferred Gift Annuities are recommended for donors aged 40 or older.

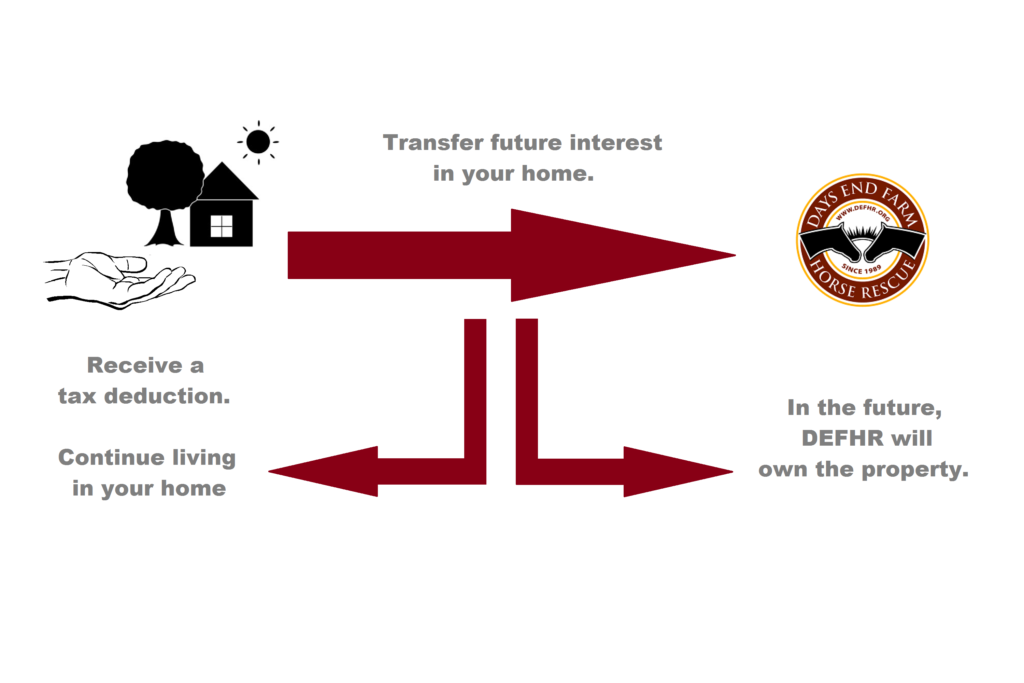

Retained Life Estates

Assure the future of your home and DEFHR’s by establishing a Retained Life Estate.

Transfer the title of your residence, farm, or vacation home to DEFHR. Continue to live in, maintain, and pay taxes on the property for life. When your life estate ends, the property passes to DEFHR.